Using Tableau, VR-Bank Mitte eG reduces analytics effort by 70%, strengthening customer retention and gaining new insights for continuous performance improvements

Time savings of 70% in data evaluation

New insights through comprehensive analyses of customer feedback

Transparency of internal situation and business development through Tableau analyses

Money transactions are a matter of trust. And because personal contact and communication with the financial institution are particularly important in this regard, VR-Bank Mitte eG conspicuously presents itself as the “Mitmachbank” (the bank to join in). With a balance sheet total of about €2.5 billion, the company serves individuals and businesses from an area of considerable size, consisting of the districts of Eichsfeld, Northeim, Göttingen and Werra-Meißner. VR-Bank Mitte eG counts around 430 full-time and part-time employees and maintains relationships with clients and members via virtually all conventional and digital channels, from its network of 30 branches to a phone and online branch, to mobile apps and presences in the social networks, to a regular podcast.

With Tableau, associates are able to analyse data from various sources without prior technological training.

Comprehensive analyses of customer feedback bring new insights about external view

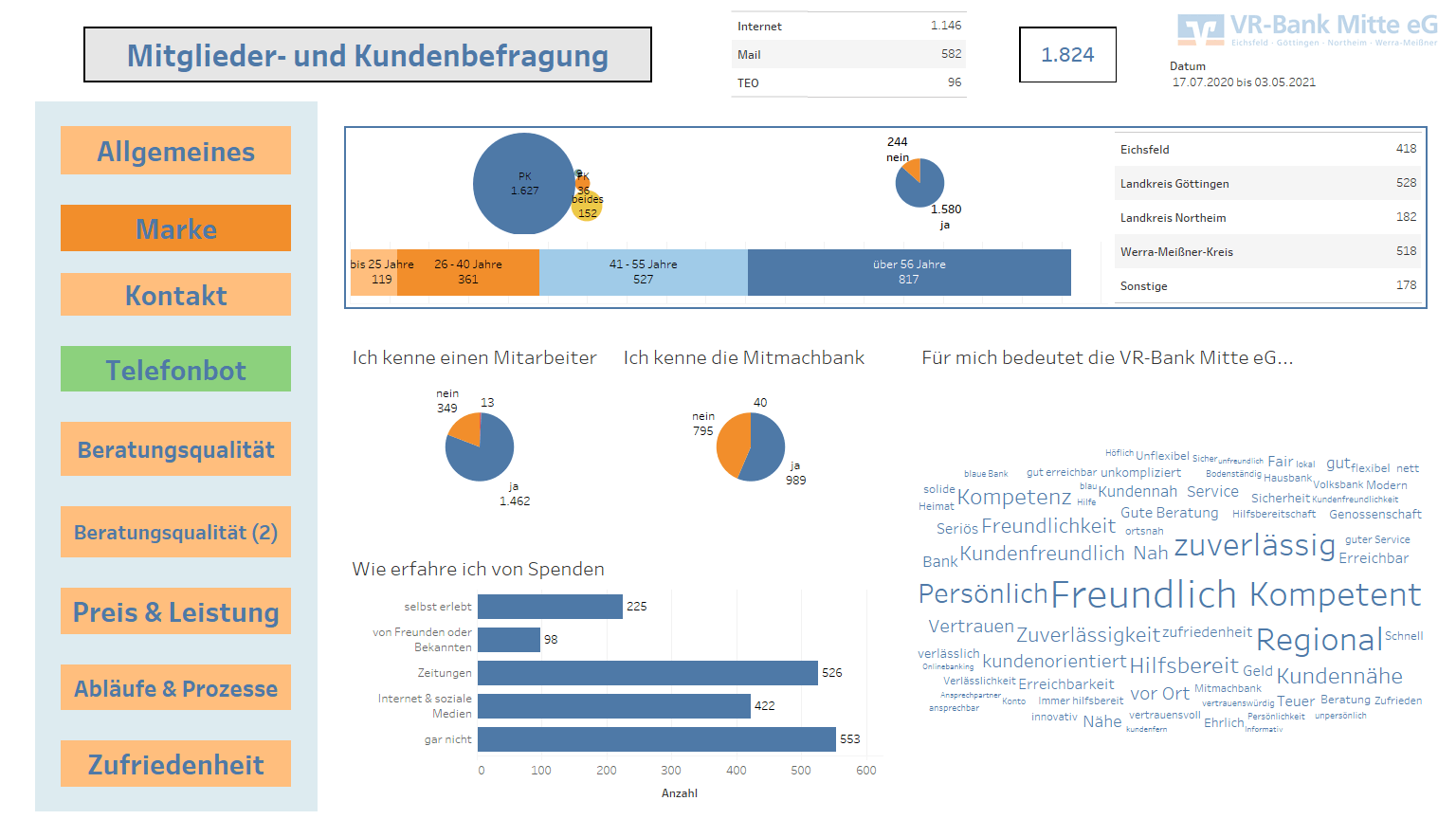

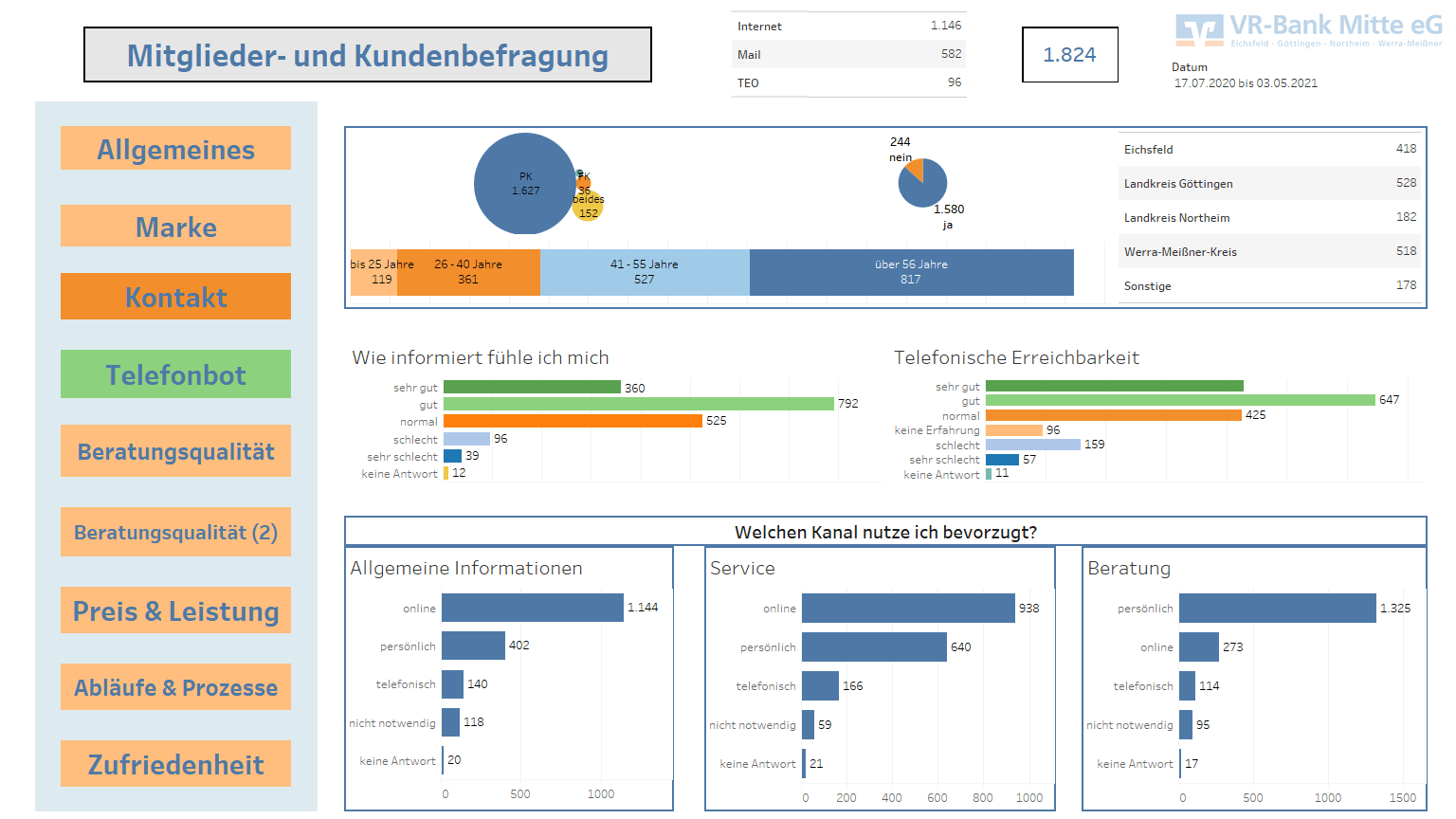

“Because our relationships with customers, members and employees are of great importance to us, we regularly ask them for detailed feedback regarding perception of our brand, our contact and consulting quality, assessment of price-performance ratio, evaluation of our processes, and general satisfaction”, explains Benedikt Lares, Head of Sales Management, VR-Bank Mitte eG. “To this end we provide a structured, multi-page online questionnaire on our website, which our visitors may use for feedback, spontaneously or after being prompted, for example by mail or after a consultation conversation. We wanted to automate and professionalise the analysis of these assessments. After an in-depth analysis of the market, we went with Tableau. Tableau reliably accompanied the decision-making process and was always on our side with advice and support. This solution enables employees to quickly analyse data from various sources even without prior technological knowledge.” In the meantime, the company has installed its own Tableau server. Three colleagues take care of server administration as well as creation of analyses and dashboards that around 35 managers access regularly. “We’ve enrolled our dashboard developers in the Tableau Academy meanwhile, to enable them to make maximum use of the solution. But for me the most impressive aspect was that, right from the beginning, they’ve created amazing analyses with Tableau, just after watching some YouTube videos and without further support.”

We saved enormous amounts of evaluation time – 60 to 70%.

Meanwhile the company has analysed close to 2,000 pieces of client feedback with Tableau. “We saved enormous amounts of evaluation time – 60 to 70%,” reports Benedikt Lares. “The interactive dashboards are updated weekly. Now we have access to the current numbers anywhere and at any time, for example in meetings and on the move from the iPad. Using filters and drill-downs, you can set the desired parameters quickly, if need be down to an individual evaluation.” Even though the new solution has only been deployed since mid-2020, the acceptance among leadership is high. Additionally, the feedback analysis is distributed quarterly to all employees as a condensed fact sheet. The predominantly positive customer feedback made the workforce feel empowered and increased their loyalty to their employer.

“Analysis of customer feedback allows evocative insights, for example in the valuation of our brand, our consulting quality, or our price-performance ratio in different age groups and regions,” explains Florian Hartleib, Regional Manager of Company Communication, VR-Bank Mitte eG. “We have, for example, noticed that our performance has often been rated higher directly after a consultation. And the ratio of referrals rose as well. We were able to take countermeasures when shortcomings were noticed, using appropriate means of communication or offers, and were able to improve customer retention continuously.”

All in all VR-Bank Mitte eG sees itself to be still at the beginning of its customer analyses. “We first wanted to establish a baseline of our external image to subsequently build on,” reports Florian Hartleib. “The results are encouraging. In the future, we can imagine defining certain feedback metrics as binding service levels.”

Colleagues aren’t put off from surveys or evaluations any longer, since the daily interaction with data has, thanks to Tableau, become much more simple and intuitive than in the past.

Transparency of internal situation and business development through Tableau analyses

Meanwhile VR-Bank Mitte eG is conducting employee surveys in a similar manner and regularly collects status reports from leadership for an overview of the internal situation. Benedikt Lares says: “Perceived shortcomings, for example regarding the furnishing of hardware and software in the workplace, are immediately visible in the illustrations by way of traffic light colours.”

Besides ongoing feedback analysis, VR-Bank Mitte eG uses Tableau for a whole range of other applications, such as analysing members, investigating usage of its online channels and ATMs, and evaluating sales results. Additional dashboards, for example to visualise credit processes, are soon to be completed or in the planning stage. Benedikt Lares explains in conclusion: “We are involving future users in the development of new dashboards to achieve high acceptance right from the start. And we are already noticing a kind of culture change. Colleagues aren’t put off from surveys or evaluations any longer, since the daily interaction with data has, thanks to Tableau, become much more simple and intuitive than in the past. The future certainly harbours even more possibilities.”